Personal Pension Plans (PPP) for incorporated business

These days, most people think of a pension as a rare privilege that can only come from a government employer.

The reality is, anyone who owns and draws a significant income from a corporation can enjoy the benefits of a pension upon retirement.

While it may not be well-publicized by other financial institutions, we set up pension plans for private business owners and high-income earners across the country, including:

✓ Doctors & dentists

✓ Lawyers or accountants

✓ People in high-tech

✓ C-Suite execs & more!

Mindset Reset

As a business owner who assumes more risk than an employee, you can boost your income in retirement by giving yourself a Personal Pension Plan (PPP). It provides a guaranteed source of income that you can’t outlive.

PPP/RCA combinations for C-Suite executives

Whether you’re a business owner or a senior executive earning max salary, you want to avoid any pension shortfalls. In other words, you want more than just a ‘comfortable’ retirement.

This is where our PPP/RCA combination can offer an elegant way of providing superior tax sheltering (without costing anything extra for the employer/company).

Retirement Compensation Arrangements (RCA)

RCA is a ‘supplemental’ pension plan that help Canadians increase their overall retirement income. They are ideally suited for high-income earners ($150,000+) such as business owners, executives and incorporated professionals who wish to sustain their standard of living into retirement.

Personal Pension Plans (PPP)

PPP is a Canadian tax-savings solution for business owner-operators and incorporated professionals looking for a smarter way to save for their retirement.

Save more and pay less tax every year

PPP creates a triple-win for business

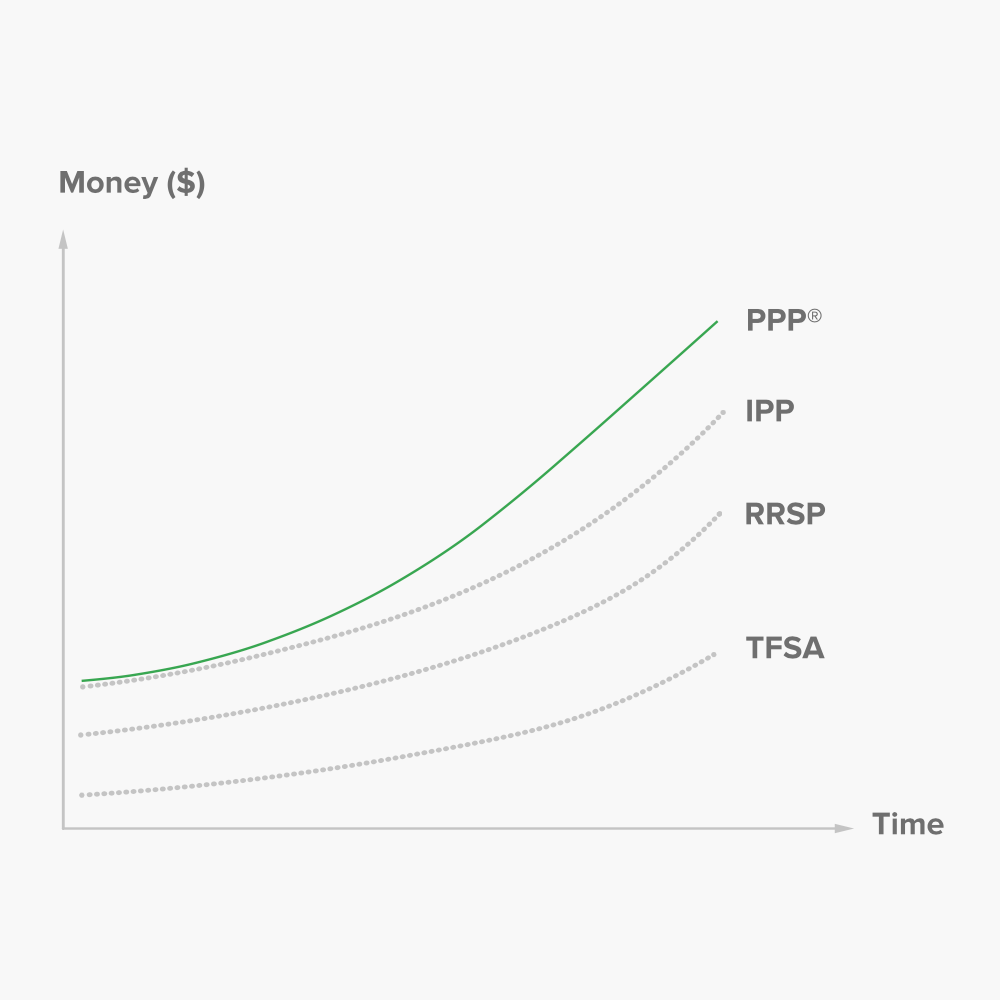

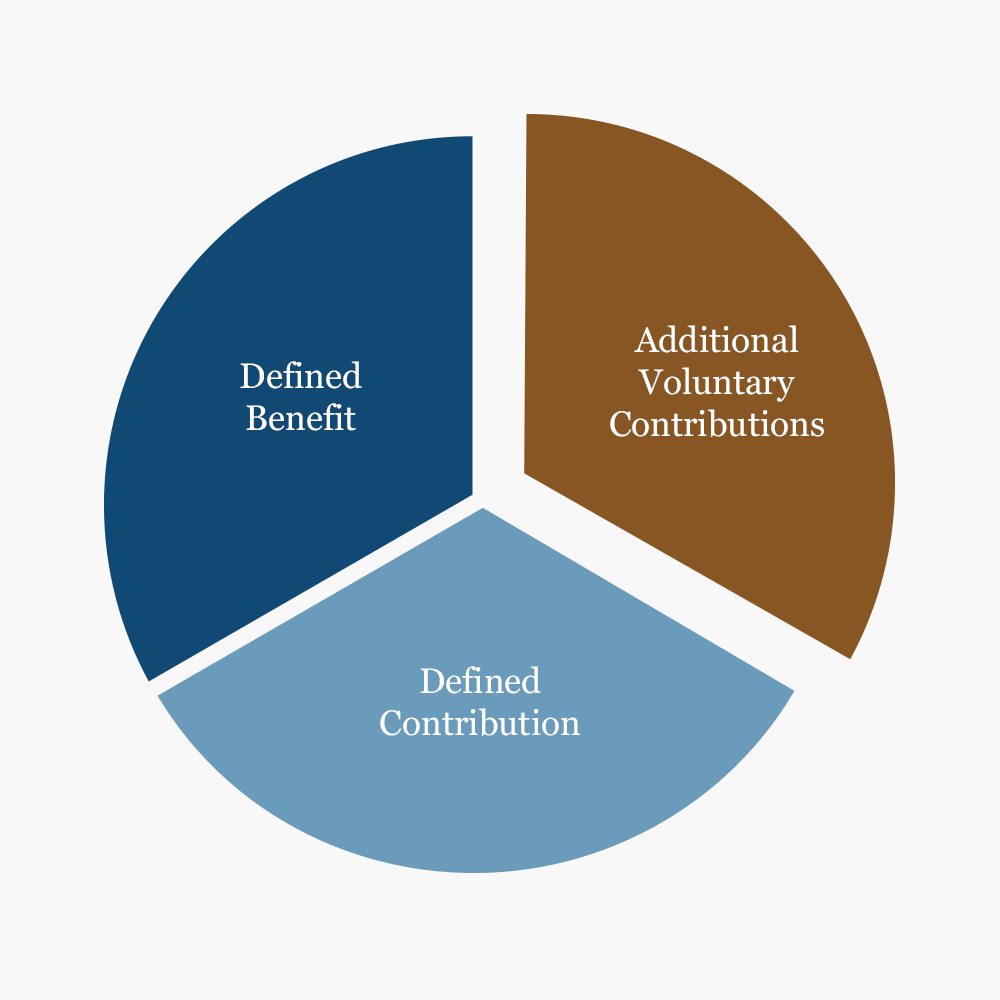

The PPP is considered a combination Registered Pension Plan (RPP) because it offers both a Defined Benefit component (everything that a conventional IPP offers) and a Defined Contribution account. Plus, it also contains an “Additional Voluntary Contribution” account (or AVC account).

For Business owners, advantages of a PPP, include:

- Contributing more funding than an RRSP

- Shielding assets from creditors

- Creating a tax deduction for the corporation

- Allowing for transfer to a beneficiary and more…

And, if you’re a business owner who can afford to pay themselves less, you can leave more money in the corporation as part of efficient tax planning.

† Graph illustration: https://integris-mgt.com/

‡ Statistical source: https://www.assomption.ca/getmedia/55d556db-14a2-42a0-b54c-8feeaf730b0f/6320-00A-Personal-Pension-Plan-Guide.aspx, page 2

*Disclaimer

This information has been prepared by Raymond Choo who is a Senior Investment Advisor for iA Private Wealth and does not necessarily reflect the opinions of iA Private Wealth. The information contained in this video comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Investment Advisor can open accounts only in the provinces in which they are registered.

iA Private Wealth is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Securities is a trademark and business name under which Industrial Alliance Securities Inc. operates.

FAQ

The term “Personal Pension Plan” is not a defined term under the Income Tax Act (Canada) but the PPP is considered an individual pension plan by CRA. It is a Registered Pension Plan (RPP) governed by Income Tax Act (ITA) Canada section.

One of the most innovative aspects of the PPP compared to an RRSP for example, is its ability to further increase the overall tax-deductible contributions an individual is legally allowed to make to a tax-deferred savings vehicle under the ITA. Plus, the PPP is the most efficient way to withdraw taxable corporate income efficiently.

“Ray is someone who treats our future like his own.”